Renting a place to call home comes with its own set of responsibilities and considerations. While your landlord's insurance policy covers the structure of the building, it does not extend coverage to your personal belongings or liability. This is where renters insurance comes into play, offering essential protection and peace of mind to tenants. In this article, we explore the significance of renters insurance, its coverage options, and why it's a crucial investment for renters.

1. Understanding Renters Insurance

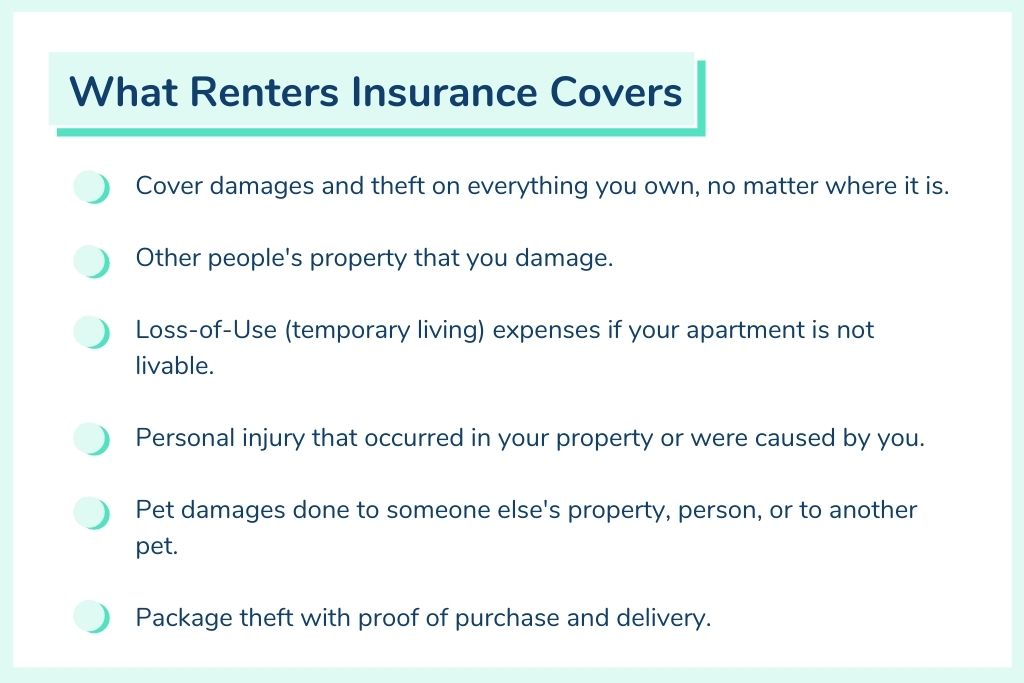

Renters insurance is a type of insurance policy designed to protect tenants and their belongings against various risks. It offers coverage for personal property, liability, and additional living expenses in the event of an insured loss. Whether you are renting an apartment, condo, or house, renters insurance ensures that you have the financial support you need when unexpected events occur.

2. Coverage for Personal Property

One of the primary components of renters insurance is coverage for personal property. This protection applies to your belongings, such as furniture, electronics, clothing, and appliances. If your possessions are damaged or destroyed by covered perils, such as fire, theft, vandalism, or water damage, renters insurance will provide funds to replace or repair them.

3. Liability Protection

Liability coverage is another critical aspect of renters insurance. It safeguards you from potential lawsuits if someone is injured while visiting your rented property. If, for example, a guest slips and falls in your home and decides to take legal action against you, your renters insurance will cover legal expenses, medical bills, and potential settlements, up to the policy's liability limit.

4. Additional Living Expenses

In the unfortunate event that your rented property becomes uninhabitable due to a covered loss, such as a fire, and you need to temporarily relocate, renters insurance can cover additional living expenses. These expenses may include hotel costs, food, and other necessary accommodations until you can return to your home or find a new one.

5. Protection against Theft

Renters insurance is particularly valuable in safeguarding your belongings against theft. If your personal property is stolen from your rental unit or while you are away, renters insurance can help replace the stolen items, allowing you to recover financially from the loss.

6. Affordable and Cost-Effective Coverage

Renters insurance is typically affordable, making it an accessible option for many tenants. The cost of renters insurance is significantly lower than that of homeowner's insurance because it only covers personal belongings and liability, not the physical structure of the building.

7. Peace of Mind for Renters

Renting a home offers flexibility and freedom, but it also comes with uncertainties. Having renters insurance provides peace of mind, knowing that you have a safety net in place to protect your belongings and financial interests. It allows you to focus on building a comfortable living space without worrying about unexpected financial setbacks.

8. Required by Landlords

In some cases, landlords may require tenants to have renters insurance as a condition of the lease. This requirement is in the best interest of both parties, as it ensures that tenants have coverage for their belongings and liability, reducing potential disputes and legal issues.

9. Customizable Coverage

Renters insurance policies can often be customized to suit your specific needs and budget. You can adjust the coverage limits and add optional endorsements to tailor the policy to your unique circumstances.

10. Coverage for Natural Disasters

Renters insurance typically covers damages caused by certain natural disasters, such as wildfires, windstorms, and lightning strikes. However, coverage for earthquakes and floods is usually not included, so additional endorsements may be necessary if you live in areas prone to these events.

11. Protection for Your Personal Belongings Anywhere

Renters insurance not only covers your personal belongings inside your rental unit but also extends protection to your possessions outside your home. For example, if your laptop is stolen from your car or your belongings are stolen while you are on vacation, your renters insurance will likely provide coverage, subject to policy limits and deductibles.

12. Coverage for Accidental Damage

13. Peaceful Coexistence with Roommates

If you are sharing your rental property with roommates, each individual can benefit from having their own renters insurance policy. While roommates may live together, their personal belongings are not covered under one policy. Having separate renters insurance ensures that each roommate's possessions and liability are protected independently.

14. Easy and Convenient Claims Process

In the event of a covered loss, the claims process for renters insurance is typically straightforward and hassle-free. Most insurance providers offer convenient online claim filing options, making it easy to submit the necessary documentation and receive reimbursement for your losses promptly.

15. Temporary Living Expenses During Home Repairs

If your rental property becomes uninhabitable due to a covered loss, such as a fire or severe water damage, renters insurance can help cover the costs of temporary living arrangements. This may include hotel stays, rental expenses, or additional living costs until your rental unit is repaired and safe to occupy again.

16. Protection against Lawsuits

In addition to liability coverage for bodily injuries that occur on your rental property, renters insurance can also provide coverage for legal defense in case you are sued for accidental damages or injuries caused by you or your family members.

17. Affordable Bundling Options

If you already have an auto insurance policy, consider bundling it with renters insurance from the same provider. Many insurance companies offer attractive discounts for bundling multiple policies, providing you with additional savings on both your auto and renters insurance premiums.

18. Rebuilding Your Life after a Disaster

Natural disasters or catastrophic events can occur unexpectedly, leaving you devastated both emotionally and financially. Renters insurance can be a lifeline during these challenging times, offering the financial support needed to rebuild your life and replace essential belongings.

19. Flexibility for College Students

Renters insurance can be an ideal solution for college students living in dormitories or off-campus housing. Even if you are a student living away from home temporarily, having renters insurance can protect your belongings and provide liability coverage, ensuring that you are not burdened with unexpected expenses during your academic journey.

20. Promoting Financial Responsibility

Renters insurance encourages financial responsibility among tenants. Having this coverage demonstrates that you are prepared for potential risks and are taking steps to protect your belongings and financial interests, which can reflect positively on your overall financial profile.

Anyone who rents an apartment, condo, townhome, or other type of dwelling should seriously consider getting renters insurance. Renters insurance covers a tenant’s personal property if it's damaged or destroyed during a break-in, a storm, or another event specified in the policy. In addition, renters insurance provides coverage for personal liability and medical bills if you have a guest over and they're injured. Finally, if there's a fire or other catastrophic event that forces you to move out of your unit, renters insurance will cover your extra living expenses, such as hotel bills and meals out.

progressive renters insurance reviews Unlike some other types of insurance policies, renters insurance is relatively simple. But there are some nuances when it comes to selecting a policy and insurance company, which is where this guide comes in. Below, we'll list our top-rated renters insurance companies of 2023 and provide more information on how renters insurance works.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Available in all 50 states, renters insurance from USAA is limited to members of the U.S. military, whether they’re active duty or retired, and their immediate family members.

A standard policy from USAA provides coverage for your personal belongings, temporary living expenses should your home become uninhabitable due to a covered event as well as liability and medical liability should someone become injured in your home. USAA’s standard policy also includes flood coverage. However, it won’t cover your roommates.

Pros.

Cons:.

Founded in 2015, Lemonade is among a new crop of online-only startups companies aiming to disrupt the insurance space. It operates as a peer-to-peer insurance provider, meaning premiums paid by customers go into a community pot that is used to pay out claims. One of the benefits that Lemonade claims for its business approach is that it can approve a policy within minutes and a claim almost instantly.

Lemonade advertises its insurance policies at highly competitive rates, starting at $5 a month for renters insurance and $25 a month for homeowners insurance

Pros.

Cons:.

Founded in 1925, Erie Insurance is based in Erie, Pennsylvania. It's probably best known for its auto and leisure insurance, but it also offers renters, homeowners, property, life, and business insurance. Erie Insurance sells relatively low-cost insurance in the mid-Atlantic and Midwest regions through 13,000 independent agents.

Pros.

Cons:.

Based in Madison, Wisconsin, American Family offers car insurance, homeowners insurance, and renters insurance, along with life insurance and other types of policies. It has agents in 19 states and serves the entire country through affiliates The General and Homesite. American Family offers a wide selection of renters insurance add-ons, like travel insurance, pet insurance, as well as coverage for home businesses and identity theft.

Pros.

Cons:.

State Farm: Bloomington, Illinois-based State Farm started out selling auto insurance and now sells renters insurance and about 100 other products. More people have car insurance and homeowners insurance with State Farm than with any other provider in the U.S., to the tune of more than 84 million policies and accounts. State Farm has a large network of agents and consistently high customer service ratings. It also now offers pet insurance through its partner Trupanion.

Pros.

Cons:.

Farmers Insurance was founded in 1928 and currently sells insurance policies of various types to more than 10 million households. Riders can be added to a Farmers policy to include coverage for identity theft, home improvements, and even mold. It offers highly customizable policies, as well as discounts for households that have been smoke-free for at least two consecutive years or have an approved security system or fire alarm. Doctors, nurses, engineers, dentists, teachers, police, and firefighters may also be eligible for discounts.

Pros.

Cons:.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Allstate was founded in 1931 as a mail-order auto insurance company by Robert E. Wood, president and board Chairman of Sears, Roebuck & Co. Based in Northbrook, Illinois, Allstate is the largest publicly held personal lines insurer and claims over 16 million customers.

Allstate is available in all 50 states and Washington, D.C. It also offers add-ons to the standard renters insurance policy, including a personal umbrella policy, which helps protect you from large liability claims, and personal property coverage.

Pros.

Cons:.

Nationwide: Columbus, Ohio-based Nationwide Mutual Insurance Company is one of the largest insurance and financial services firms in the U.S. It features many types of insurance for individuals and companies, including auto, life, pet, homeowners, and business insurance, as well as financial products like mutual funds. Nationwide employs some 30,000 people throughout the U.S. and can provide insurance quotes and policies online or through an agent.

Pros.

Cons:.

Liberty Mutual started in 1912, is based in Boston, and is one of the largest global property and casualty insurers in the U.S. About 50,000 people around the world work for Liberty Mutual. Its renters insurance premiums start as low as $5 a month, and it provides the option of replacement cost coverage. In addition to renters insurance, it offers auto, homeowners, commercial, workers' compensation, general liability, surety, and commercial property insurance, as well as specialty insurance lines.

Pros.

Cons:.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Q1. What is renters insurance, and why do I need it?

Ans: Renters insurance is a type of insurance policy that provides coverage for tenants who rent their homes or apartments. It protects the tenant's personal belongings, liability, and additional living expenses in the event of covered losses, such as theft, fire, or water damage. Renters insurance is essential because it offers financial security and peace of mind, ensuring that tenants are protected from unexpected events and potential liabilities.

Q2. What does renters insurance typically cover?

Ans: Renters insurance typically covers three main areas:

A) Personal Property: It provides coverage for your belongings, including furniture, electronics, clothing, and other personal items in case of covered losses like theft, fire, vandalism, or water damage.

B) Liability: It offers protection if you are held legally responsible for accidental injuries to others or property damage caused by you, your family members, or even your pets.

C) Additional Living Expenses: If your rental unit becomes uninhabitable due to a covered loss, renters insurance can cover the additional living expenses incurred while you stay elsewhere temporarily.

Q3. Is renters insurance mandatory?

Ans: Renters insurance is generally not mandatory by law. However, some landlords may require tenants to have renters insurance as a condition of the lease to protect their own interests and encourage responsible tenancy.

Q4. How much does renters insurance cost?

Ans: The cost of renters insurance can vary based on factors such as the location of the rental property, the level of coverage selected, the deductible amount, and the tenant's claims history. On average, renters insurance is relatively affordable, often costing a few hundred dollars per year.

Q5. Can I get renters insurance if I live with roommates?

Ans: Yes, if you live with roommates, you can each have your own renters insurance policy to protect your personal belongings and liability independently. It's a good practice for each individual to have their own coverage.

Q6. Does renters insurance cover natural disasters?

Ans: Renters insurance typically covers damages caused by common perils, such as fire, theft, vandalism, and water damage from burst pipes. However, coverage for natural disasters like earthquakes and floods is usually not included in standard policies and may require additional endorsements.

Q7. Can I bundle renters insurance with other insurance policies?

Ans: Yes, many insurance providers offer bundling options, allowing you to combine renters insurance with other policies, such as auto insurance. Bundling multiple policies with the same insurance company often leads to discounts, making it a cost-effective choice.

Q8. How do I file a claim with renters insurance?

Ans: If you experience a covered loss, you can file a claim with your renters insurance provider by contacting their claims department. Typically, you'll need to provide details of the incident, including a description of the loss and any supporting documentation, such as photographs or receipts.

Q9. Are my belongings covered if I travel with them outside of my rental property?

Ans: Yes, renters insurance usually extends coverage to your belongings even when you are away from your rental property. If your personal property is stolen or damaged while traveling, your renters insurance can help reimburse you for the losses.

Q10. Can I get renters insurance if I have a pet?

Ans: Yes, having a pet does not disqualify you from getting renters insurance. However, it's essential to inform the insurance company about your pet, as some policies may have certain limitations or exclusions related to specific breeds or types of pets.

Q11. What is the difference between actual cash value and replacement cost coverage in renters insurance?

Ans: When it comes to personal property coverage in renters insurance, there are two main types: actual cash value (ACV) and replacement cost coverage.

Actual Cash Value (ACV): With ACV coverage, the insurance company reimburses you for the value of your belongings at the time of the loss, taking into account depreciation. This means that you'll receive the current market value of the item, which may be lower than its original purchase price. ACV coverage is generally more affordable, but it may not fully cover the cost of replacing your items with new ones.

Replacement Cost Coverage: With replacement cost coverage, the insurance company reimburses you for the full cost of replacing your belongings with new ones of similar kind and quality, without factoring in depreciation. This means that you'll receive enough money to buy a brand-new replacement for the items that were damaged or stolen. While replacement cost coverage may have a slightly higher premium, it provides more comprehensive coverage and ensures that you can replace your belongings without bearing a significant financial burden.

Q12. Can I transfer my renters insurance if I move to a new rental property?

Ans: Yes, renters insurance is generally transferable to a new rental property. If you move to a new place, you can update your policy with the new address and any other relevant information. Keep in mind that your premium might change based on the location and other factors specific to the new rental property.

Q13. Does renters insurance cover my roommate's belongings?

Ans: No, renters insurance typically covers only the belongings of the policyholder (the named insured). Your roommate would need their own renters insurance policy to protect their personal belongings. It's crucial for each tenant to have their own policy, even if they share the same rental unit.

Q14. Can I cancel my renters insurance policy at any time?

Ans: Yes, you can cancel your renters insurance policy at any time. Most insurance providers have a straightforward cancellation process. However, keep in mind that canceling your policy means you will no longer have coverage for your belongings and liability. If you decide to cancel, make sure to do so only when you have secured alternative coverage or when you no longer need the protection.

Q15. Does renters insurance cover damages caused by my pets?

Ans: Renters insurance typically includes liability coverage, which can protect you if your pet causes injuries to others or damages their property. However, some insurance policies may have breed restrictions or exclusions for certain animals, so it's crucial to review the policy terms to understand your coverage in relation to your pets.

Q16. Can I get renters insurance if I live in a shared living space, such as a dormitory or shared apartment?

Ans: Yes, renters insurance is available for individuals living in shared living spaces, such as dormitories or apartments with roommates. It's essential to inform the insurance company about the living arrangement, as the policy may need to be tailored to suit the specific setup.

Q17. How do I determine the amount of coverage I need for my personal belongings?

Ans: To determine the appropriate amount of coverage for your personal belongings, take an inventory of all your possessions, including furniture, electronics, clothing, jewelry, and other valuable items. Calculate the total value of these belongings and choose a coverage limit that adequately protects your assets in case of a total loss.

Q18. Is my bicycle covered under renters insurance?

Ans: Yes, most renters insurance policies include coverage for bicycles. However, there may be limits on the coverage amount for specific categories of belongings, so it's essential to review the policy details and consider adding additional coverage if needed, especially for high-value items like expensive bicycles.

Q19. Can I get renters insurance if I have a history of prior claims or poor credit?

Ans: While a history of prior claims or poor credit may impact your ability to get renters insurance with some providers, there are insurance companies that specialize in providing coverage for individuals with unique circumstances. It's advisable to shop around and speak with different insurance providers to find one that can offer the best coverage options despite any previous claims or credit issues.

Q20. How do I get a renters insurance policy?

Ans: Getting a renters insurance policy is relatively simple. You can start by researching reputable insurance providers and requesting quotes online or by contacting their customer service. Compare the coverage options, premiums, and deductibles offered by different companies. Once you've chosen a policy that suits your needs, you can apply for the coverage, and the insurance provider will guide you through the process of setting up your renters insurance policy.

© Insurance Life Plan. All Rights Reserved. POWERD BY ![]()