The National Flood Insurance Program (NFIP), overseen by FEMA, is distributed to the public via a consortium of over 50 insurance enterprises and the NFIP Direct.

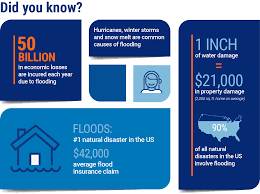

Floods have the potential to strike anywhere—just one inch of floodwater has the capacity to instigate up to $25,000 in devastation. Conventional homeowners' insurance typically disregards flood-induced harm. Flood insurance, however, represents a distinct policy capable of sheltering both structures and the contents within them. Thus, safeguarding your paramount fiscal assets—your abode, your enterprise, your possessions—becomes imperative.

The NFIP extends flood insurance coverage to property possessors, lessees, and commercial ventures. Possessing such coverage expedites recuperation as floodwaters recede. The NFIP collaborates with communities obligated to embrace and enforce floodplain management edicts, which serve to alleviate the consequences of flooding.

Flood insurance is attainable for anyone residing in one of nearly 23,000 participating NFIP communities. Residences and establishments situated in flood-prone zones, backed by government-affiliated lenders, bear an obligation to maintain flood insurance.

Catastrophic events, exemplified by floods, can impose severe havoc upon domiciles and possessions, exacting colossal financial repercussions and emotional turmoil. Floods materialize without warning, transcending geographic confines. Although homeowners' insurance provides a measure of indemnity, it often omits flood-related liabilities. This is where flood insurance emerges as an indispensable safety mesh, affording vital financial protection against the adversities of nature. Within this discourse, we shall delve into flood insurance, its significance, coverage alternatives, and its role as a bulwark for your residence and financial resources against nature's turbulence.

Comprehending Flood Insurance

Flood insurance embodies a specialized insurance contract tailored to address losses and impairments precipitated by floods. In stark contrast to homeowners' insurance, which generally extends its protective umbrella over losses from fire, larceny, and select natural disasters, flood insurance centers its attention squarely on the provision of fiscal insulation against flood-triggered losses. Flood insurance is typically dispensed through the National Flood Insurance Program (NFIP) in the United States or via private insurance firms partaking in the NFIP's Write Your Own (WYO) initiative.

The Significance of Flood Insurance

Floods can materialize due to sundry catalysts, including torrential precipitation, surges unleashed by storms, snowmelt, or dam breaches. They can inflict widespread havoc upon real estate, eradicating architectural frameworks, possessions, and even imperiling human lives. The journey of convalescence from flood-inflicted destruction can be financially burdensome, particularly in the absence of flood insurance. Therein lies the importance of flood insurance, underpinned by several factors:

Financial Safeguarding: Flood insurance bestows imperative fiscal security, underwriting the expenses entailed in rehabilitation, reconstruction, and replacement of impaired assets. Absent flood insurance, property holders may grapple with the onus of funding these outlays independently.

Tranquility of Mind: The assurance of possessing flood insurance furnishes serenity, even amidst protracted downpours or flood advisories. This affords the liberty to focus on safeguarding loved ones and possessions, sans the specter of financial repercussions stemming from flood devastation.

Provision of Aid: Flood insurance frequently encompasses provisions for temporary lodging expenses if one's residence succumbs to inundation, rendering it uninhabitable. This support facilitates the quest for alternative accommodations during the interval required for the reconstitution of the domicile.

Community Imperatives: Certain mortgage providers may mandate the acquisition of flood insurance for properties nestled within high-risk flood zones. Adherence to this stipulation is imperative for securing mortgage approval for the property.

Varieties of Flood Insurance

Flood insurance generally falls into two categories: dwelling coverage and contents coverage.

Dwelling Coverage: This variant of flood insurance blankets the structural components of your abode, encompassing the foundation, walls, electrical and plumbing networks, HVAC units, and inbuilt appliances.

Contents Coverage: Contents coverage extends its umbrella over personal possessions, including furniture, attire, electronic gadgets, and miscellaneous assets susceptible to damage or obliteration by floodwaters.

Homeowners retain the liberty to select both dwelling and contents coverage to assure comprehensive protection against losses precipitated by flooding

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Flood Zones and Risk Factors

Flood zones constitute geographical regions categorized according to their flood hazard intensity. The Federal Emergency Management Agency (FEMA) undertakes the task of flood zone delineation. Residences situated within high-risk flood zones face elevated vulnerability to inundation compared to those nestled in zones marked as low to moderately hazardous. Legally mandated is the possession of flood insurance by properties located in high-risk flood zones, granted the homeowner holds a mortgage backed by the federal apparatus.

Nevertheless, it is pivotal to underscore that floods remain unpredictable, capable of manifesting their watery fury in locales extending beyond high-risk domains. In fact, an astounding 20% of flood insurance claims emanate from properties occupying territories situated outside the high-risk demarcation. Hence, homeowners spanning all geographic spectrums are fervently encouraged to ponder the acquisition of flood insurance, thereby ensuring the safeguarding of their abodes and financial interests.

Cost and Coverage

The pecuniary outlay associated with flood insurance stands as a variable contingent upon several determining factors. These variables encompass the property's geographical disposition, the extent of flood vulnerability, the quantum of coverage sought, and the specific category of coverage opted for. Properties perched within high-risk flood zones tend to attract loftier premium rates compared to their low to moderately vulnerable counterparts.

Coverage limits in the realm of flood insurance are contingent upon the stipulations of the policy and the insurance purveyor. It behooves homeowners to meticulously scrutinize their policy, comprehending the facets encompassed within it and those which find themselves in the exclusionary orbit. As an illustration, certain policies may extend their mantle of protection over structural impairment while abstaining from indemnifying losses incurred by personal possessions.

How to Procure Flood Insurance: A Thorough Guide Floods are capricious forces capable of inflicting profound damage upon residential edifices and assets. While homeowners' insurance grants coverage against an array of calamities, it frequently renders itself impotent in the face of flood-related peril. To shield your abode and financial resources from the onslaught of flooding, the acquisition of flood insurance emerges as a decisive stride. Within this exhaustive guide, we shall escort you through the labyrinthine process of securing flood insurance, bestowing upon you the acumen necessary to effectuate an educated choice and secure the protection you seek.

Step 1: Appraise Your Flood Peril

The inaugural rung in the procurement of flood insurance entails a comprehensive assessment of your exposure to flood jeopardy. It becomes imperative to ascertain if your property lies ensconced within a flood-prone milieu, a classification typically designated as a high-risk flood zone by FEMA. These domains exhibit a heightened propensity for inundation. It remains incumbent to remain cognizant that floods are not confined exclusively to high-risk enclaves; even areas labeled as moderate to low risk are susceptible to the deluge's caprices. Delve into the annals of past flood occurrences within your vicinity, and peruse flood cartography to decode your property's vulnerability to flooding.

Step 2: Discern Your Coverage Requisites

Once you've navigated the realm of flood vulnerability, turn your gaze toward the contours of your coverage requirements. Calculate the monetary worth of your domicile and its content. Dwelling coverage casts a protective shield over the structural components of your residence, encapsulating the foundation, walls, and intrinsic appliances. Contents coverage extends its umbrella of protection to encompass personal effects, inclusive of furniture, electronic gadgets, attire, and valuables. The summation of both valuations assumes paramount significance, ensuring the presence of commensurate coverage to facilitate the reconstruction and replenishment of your possessions in the event of a deluge.

Step 3: Delve into Insurance Alternatives

Two primary avenues exist for securing flood insurance: the National Flood Insurance Program (NFIP) and private insurance emporiums. The NFIP, a government initiative, disseminates flood insurance within participating communities. Concurrently, private insurers proffer flood insurance policies, often augmenting NFIP provisions with supplementary coverage alternatives. Undertake meticulous research and conduct comparisons with regard to coverage span, premiums, and the reputability of the insurance underwriters to pinpoint the optimal fit for your exigencies.

Step 4: Solicit Flood Insurance Quotations

Upon the narrowing of your options, initiate the solicitation of flood insurance quotations from multiple carriers. Scrutinize the frontiers of coverage, deductibles, exclusions, and appended features tendered within each policy. Bear in mind that flood insurance premium structures oscillate contingent upon variables such as geographic placement, elevation, and flood susceptibility. Engaging multiple insurers in quotation procurement affords you the opportunity to pinpoint a policy that reconciles the confluence of coverage sufficiency and fiscal viability.

Step 5: Consultation with an Insurance Maven

Traversing the labyrinth of flood insurance can prove labyrinthine, warranting the counsel of a certified insurance maven. Seasoned agents, well-versed in the intricacies of flood insurance, stand poised to furnish clarifications, respond to queries, and dispense invaluable insights. Their purview encompasses the identification of discounts or economizing prospects, tailoring the policy to bespoke specifications.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Flood Zones and Risk Factors

Flood zones represent delineated geographical territories categorized according to their susceptibility to flooding. These designations are the purview of the Federal Emergency Management Agency (FEMA). Residences occupying high-risk flood zones exhibit heightened vulnerability to inundation compared to their counterparts nestled within zones characterized as having low to moderate flood risks. Notably, homeowners in high-risk flood zones, who hold federally-backed mortgages, are mandated by law to secure flood insurance.

Nonetheless, it's imperative to underscore that flood occurrences are not confined solely to high-risk locales. A noteworthy statistic reveals that in excess of 20% of flood insurance claims emanate from properties located outside the precincts of high-risk zones. Consequently, homeowners in all geographical regions are strongly encouraged to contemplate the acquisition of flood insurance, thereby fortifying their dwellings and financial interests.

Cost and Coverage

The fiscal outlay associated with flood insurance is contingent upon several factors. These determinants encompass the geographical positioning of the property, the extent of flood risk, the desired coverage quantum, and the specific genre of coverage selected. Invariably, properties domiciled within high-risk flood zones attract heftier premium outlays relative to their low to moderate flood risk counterparts.

Within the domain of flood insurance, coverage thresholds hinge on the tenets of the policy and the insurance provider in question. It is imperative for homeowners to meticulously peruse their policies, fully comprehending the domains encompassed by coverage and those relegated to exclusion. For instance, certain policies may extend coverage over structural impairments while withholding indemnification for losses incurred by personal possessions.

How to Procure Flood Insurance: An All-Encompassing Handbook Floods wield the potential to inflict substantial devastation upon residences and assets. While conventional homeowners' insurance extends protective coverage across a panoply of perils, it frequently remains silent in the face of flood-related perils. In order to shield one's property and financial interests from the ravages of flooding, the acquisition of flood insurance represents a pivotal stride. Within this exhaustive manual, we shall shepherd you through the labyrinthine process of securing flood insurance, thus endowing you with the sagacity requisite to effect an informed choice and secure the requisite protection.

Step 1: Evaluate Your Flood Risk

The maiden step in procuring flood insurance entails a rigorous assessment of your exposure to flood hazards. It becomes paramount to ascertain whether your property finds itself ensconced within a flood-prone realm, typically anointed as high-risk flood zones by FEMA. These territories bear a heightened probability of experiencing inundation. However, it is imperative to bear in mind that floods possess the capability to materialize irrespective of the designation, even in regions characterized as possessing moderate to low flood risks. Engage in a retrospective examination of past flood occurrences within your vicinity, while simultaneously consulting flood cartography to decode your property's susceptibility to flooding.

Step 2: Grasp Your Coverage Prerequisites

Subsequent to navigating the arena of flood vulnerability, direct your focus towards the contours of your coverage requisites. Ascertain the monetary worth of your domicile and its contents. Dwelling coverage erects a bulwark around the tangible facets of your residence, encompassing elements such as the foundation, walls, and inbuilt appliances. Meanwhile, contents coverage envelops your personal possessions, inclusive of furnishings, electronic equipment, attire, and items of pecuniary value. Compute the cumulative value of both realms to ensure the presence of coverage commensurate with the ability to reconstruct and replenish your belongings in the eventuality of a deluge.

Step 3: Probe Insurance Alternatives

Flood insurance is derivable from two principal sources: the National Flood Insurance Program (NFIP) and private insurance purveyors. The NFIP, a governmental initiative, disburses flood insurance within participating communities. Parallelly, private insurers offer flood insurance policies, frequently embellishing NFIP provisions with supplementary coverage alternatives. Engage in meticulous research and effectuate comparisons with respect to the expanse of coverage, premium outlays, and the reputation of insurance providers, in order to identify the optimal match for your exigencies.

Step 4: Attain Flood Insurance Quotations

Upon the winnowing of your options, initiate the process of soliciting flood insurance quotations from multiple providers. Scrutinize the confines of coverage, deductibles, exclusions, and augmentative features proffered within each policy. Bear in mind that flood insurance premium matrices oscillate contingent upon variables such as the property's geographical placement, elevation, and flood risk magnitude. Soliciting quotations from sundry insurers facilitates the pinpointing of a policy that reconciles the equilibrium between coverage sufficiency and financial feasibility.

Step 5: Consultation with an Insurance Savant

Traversing the labyrinthine terrain of flood insurance can prove to be intricate, thereby underscoring the necessity for guidance from a certified insurance savant. Seasoned agents, well-versed in the intricacies of flood insurance, stand poised to provide clarifications, respond to inquiries, and impart valuable insights. Their gamut extends to the identification of discounts or economizing possibilities, customizing the policy to align with your precise requisites.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Affordable Flood Insurance Coverage: Seek flood insurance policies that offer comprehensive protection without straining your budget, ensuring your property remains safeguarded.

Top Flood Insurance Companies: Discover reputable and dependable insurance providers offering high-quality flood insurance policies.

Flood Insurance Quotes Online: Easily obtain quotes for flood insurance policies from multiple providers through online platforms or tools.

Best Flood Insurance Rates: Find flood insurance policies with the most competitive and cost-effective premium rates available.

Flood Insurance Near Me: Locate local insurance providers or agents offering flood insurance policies in your area.

Cheap Flood Insurance Policies: Secure flood insurance plans with low premiums while still ensuring sufficient coverage against flood-related losses.

Low-Cost Flood Insurance Options: Explore affordable flood insurance choices that meet your specific needs and budget.

Flood Insurance for Homeowners: Protect your residence and belongings from flood damages with specialized flood insurance coverage for homeowners.

Comprehensive Flood Insurance Plans: Discover flood insurance policies offering broad coverage, safeguarding against a wide range of flood-related losses.

Compare Flood Insurance Premiums: Compare the costs of premium rates across different flood insurance policies to identify the most suitable option.

Flood Insurance Benefits Explained: Understand the advantages and coverage benefits provided by flood insurance policies.

Understanding Flood Insurance Policies: Gain detailed insights into how flood insurance policies function, including their terms, conditions, and coverage details.

Buy Flood Insurance Online: Conveniently purchase flood insurance policies online through dedicated platforms or directly from insurance companies' websites.

Flood Insurance for Renters: Protect your personal belongings as a renter with flood insurance coverage in the event of flooding.

Flood Insurance for Businesses: Safeguard your commercial properties and assets with specialized flood insurance coverage tailored for businesses.

Flood Insurance for High-Risk Areas: Explore flood insurance options designed specifically for properties located in regions with a high risk of flooding.

Flood Insurance vs. Homeowners Insurance: Understand the distinctions between flood insurance and standard homeowners' insurance policies, emphasizing the necessity for separate flood coverage.

Best Flood Insurance Providers: Identify and evaluate the most reputable and top-rated flood insurance providers available in the market.

Flood Insurance Coverage Limits: Gain insights into the maximum coverage amounts provided by flood insurance policies for various types of losses.

Flood Insurance Claim Process: Learn about the process of filing flood insurance claims and the steps involved in initiating and completing a successful claim.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Q1. What Does Flood Insurance Encompass?

Ans: Flood insurance is an insurance policy tailored to address losses and damages stemming from flooding. It extends financial protection to homeowners and property owners, covering both the structural elements and the contents housed within the property.

Q2. Does Standard Homeowners' Insurance Extend to Floods?

Ans: Standard homeowners' insurance typically steers clear of flood-related perils. In essence, flood insurance stands as a separate, requisite policy for homeowners, bridging the gap and safeguarding property from flood-induced losses.

Q3. How Do I Determine My Need for Flood Insurance?

Ans: Evaluating the necessity for flood insurance hinges on a comprehensive analysis of your property's flood susceptibility. This entails consulting flood maps and evaluating the historical flood occurrences in your locale. High-risk flood zones may necessitate flood insurance.

Q4. Where Can I Procure Flood Insurance?

Ans: Flood insurance is attainable through the National Flood Insurance Program (NFIP) or via private insurance companies participating in the NFIP's Write Your Own (WYO) initiative. Homeowners can liaise with their insurance agents or explore available options on the NFIP website.

Q5. Can Renters Access Flood Insurance?

Ans: Indeed, renters can secure flood insurance to shield their personal possessions from flood-related devastation. This coverage operates independently of the landlord's insurance, which typically caters to structural aspects alone.

Q6. What Constitutes Coverage Under Flood Insurance?

Ans: Flood insurance conventionally extends coverage to property structural components, encompassing foundations, walls, and major systems like electrical and plumbing. Additionally, it blankets the property's contents, embracing furniture, appliances, and personal effects.

Q7. Is Flood Insurance Legally Mandated?

Ans: Legally, flood insurance is not universally required. Nevertheless, if your property sits within a high-risk flood zone and you possess a federally-backed mortgage, your lender may insist on flood insurance as a prerequisite.

Q8. What Is the Price Tag on Flood Insurance?

Ans: Flood insurance costs are contingent upon factors such as property location, flood risk assessment, coverage magnitude, and deductible preferences. Premiums span a spectrum, ranging from several hundred to a few thousand dollars annually.

Q9. Is There a Waiting Period for Flood Insurance Coverage?

Ans: Typically, a 30-day waiting period accompanies flood insurance coverage. It is prudent to procure flood insurance well in advance, particularly before the onset of flood seasons or imminent flood risk.

Q10. Can I Lodge a Flood Insurance Claim Online?

Ans: Yes, numerous insurance providers offer the convenience of online flood insurance claims submission through their websites or mobile applications. Alternatively, you can initiate the claims process by contacting your insurance agent or the company's claims department.

Q11. Does Flood Insurance Account for Temporary Living Expenses?

Ans: Generally, flood insurance does not encompass temporary living expenses such as hotel costs during home repairs. However, your homeowners' insurance policy might extend coverage for additional living expenses in such circumstances.

Q12. Can I Cancel Flood Insurance After Flood Season?

Ans: Indeed, flood insurance can be canceled at your discretion. Nonetheless, it is prudent to evaluate the flood risk in your area and contemplate the potential consequences of remaining uninsured during a flood event. Maintaining continuous coverage is pivotal for unexpected flood protection.

Q13. Are There Any Exclusions in Flood Insurance Policies?

Ans: Flood insurance policies might feature exclusions, which could pertain to damages originating from sewer backups or negligence. A thorough review of your policy is advisable to discern coverage inclusions and exclusions.

Q14. Is Basement Coverage Included in Flood Insurance?

Ans: Flood insurance can indeed encompass basements, covering structural components and essential equipment like water heaters and sump pumps. However, coverage limitations might apply to personal belongings located in the basement.

Q15. Can I Obtain Flood Insurance Outside High-Risk Zones?

Ans: Absolutely, flood insurance is available to homeowners and property owners residing beyond high-risk flood zones. Interestingly, over 20% of flood insurance claims arise from properties situated in areas characterized by moderate to low flood risk

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

© Insurance Life Plan. All Rights Reserved. POWERD BY ![]()