Unveiling the Essence of Disability Insurance:

Disability insurance stands as a pivotal shield, an unyielding bastion safeguarding the fiscal future of individuals against the specter of incapacitation. It emerges as a financial guardian, ready to step in when individuals find themselves unable to discharge their professional duties due to debilitating circumstances. In a realm where conventional insurance predominantly concerns itself with medical expenditure, disability insurance carves its own niche. It is meticulously crafted to bridge the financial chasm, aiming to replace a portion of one's earnings in the event of an inability to perform job duties resulting from illness or injury.

The Weight of Disability Insurance:

Life's capricious nature dictates that accidents or illnesses can strike at any moment, casting an ominous shadow of unpredictability. The aftermath of a disability can unfurl a tapestry of financial devastation, marked by income loss and the relentless rise of medical bills. In this trying time, disability insurance stands as an unwavering pillar, striving to alleviate the financial burdens that cripple individuals. It ensures that even when the ability to work diminishes, financial commitments remain steadfastly met.

Disability insurance isn't merely a financial shield; it's a lifeline. It means having a consistent income source when the road ahead is fraught with challenges. It embodies peace of mind, reassuring individuals that their financial future is secure, allowing them to focus on recuperation without the specter of financial ruin looming overhead.

Varieties of Disability Insurance:

The realm of disability insurance unfurls in two primary shades: the ephemeral embrace of short-term disability insurance and the enduring cloak of long-term disability insurance.

The Fleeting Respite: Short-Term Disability Insurance: This category of insurance offers coverage for a finite duration, often up to six months. It swings into action swiftly after the policyholder grapples with disability and is rendered incapable of working. This genre of insurance holds particular significance in its ability to cushion immediate financial blows and sustain a source of income during the initial stages of disability.

Short-term disability insurance serves as a financial buoy for individuals anticipating a brief recovery period. It provides the crucial safety net required in the critical phase following the onset of disability, affording the policyholder time to convalesce and return to the workforce.

The Resilient Shelter: Long-Term Disability Insurance: In stark contrast, long-term disability insurance extends its protective wing over an extended span, at times spanning several years or enduring until the policyholder approaches the shores of retirement. This category of insurance paints a more comprehensive safety net, guarding against the prolonged financial tribulations that accompany severe disability.

Long-term disability insurance emerges as a stalwart ally for those grappling with disabilities of extended duration or those destined to face a lasting impact on their employability. It assures a steady stream of income to underpin daily living expenses, medical interventions, and the ongoing care necessitated by significant challenges.

Unraveling the Mechanics of Disability Insurance:

When an individual secures a disability insurance policy, they embark on a voyage marked by periodic premium contributions, typically made on a monthly or annual basis. Should the grim specter of disability descend and render them unable to work, the lifeline of a claim can be unfurled, beckoning the receipt of disability benefits. These benefits typically amount to a percentage of the policyholder's pre-disability income, ensuring that they remain buoyed by some financial support during their hour of need.

It's worth noting that the pursuit of a disability insurance claim often entails the submission of medical documentation and evidence attesting to the presence of disability. Once the claim garners approval, regular disbursements commence, serving as a partial replacement for the income that has dwindled. It's noteworthy that disability insurance benefits are generally exempt from taxation, rendering them a dependable and invaluable source of financial support during the tumultuous times of adversity.

Factors to Ponder When Selecting Disability Insurance:

A multitude of considerations should be etched into one's decision-making canvas when perusing disability insurance policies:

Coverage Quota: Assure that the policy's protective embrace encompasses a substantial portion of your income, poised to step in should disability knock on your door.

Waiting Interlude: Pay heed to the interval preceding the commencement of benefits. A lengthier waiting period may translate to reduced premiums but entails a protracted spell without benefits. Assess your financial preparedness for short-term disabilities in the interim.

Tenure of Coverage: Gauge the temporal span during which the policy extends its benefits. Longer coverage signifies a robust safety net but may necessitate higher premium commitments. Tailor the duration to your age, health status, and vocational circumstances.

Occupational Considerations: Delve into the policy's provisions concerning occupation specificity. Ascertain if your profession receives adequate coverage. Occupations marked by heightened risk may warrant specialized policies or may be subject to specific exclusions.

Interpretation of Disability: Grasp the policy's interpretation of disability. Some policies restrict disability to the inability to work in one's current occupation, while others adopt a broader lens, considering one's ability to engage in any suitable occupation, given their skill set and qualifications.

Renewability and Portability: Explore the policy's stance on renewability and portability. A renewable policy assures continued coverage without the need for fresh rounds of medical underwriting, while a portable policy remains in force even if you traverse different employment landscapes.

Supplementary Riders: Investigate supplemental riders or add-ons that could enhance your disability insurance coverage. These could include adjustments for cost-of-living, residual disability benefits, or the option to acquire additional coverage in the future.

Employer-Sourced Versus Private Disability Insurance:

Many employers extend disability insurance as part of their employee benefits package. While this may seem convenient, it's paramount to fathom the confines of employer-provided coverage. Frequently, such insurance may fall short in delivering adequate protection and may not be transferrable if you shift career lanes.

Conversely, private disability insurance policies unfurl a tapestry of flexibility and personalization. They can be meticulously tailored to align with your distinct needs and persist regardless of career transitions. Private policies often extend more encompassing protection and might encompass supplementary riders that can prove advantageous in your particular circumstances.

In Conclusion: Embracing the Aegis of Financial Stability:

Disability insurance, an intrinsic element of financial planning, offers the promise of serenity amidst the tumult of uncertainty. By making judicious selections regarding policy and coverage, individuals etch a path to shield their fiscal future and nurture a sense of security in the face of the unforeseen trials of life. Researching and comprehending the plethora of available options is pivotal, and consulting with insurance experts can provide valuable guidance in making decisions that harmonize with individual circumstances and prerequisites.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Diverse Disability Insurance Choices in the United States:

Social Security Disability Insurance (SSDI): A federal initiative furnishing disability benefits to those who have actively contributed to Social Security through their work and are now confronted with a disability anticipated to endure for a minimum of one year or culminate in fatality.

Supplemental Security Income (SSI): Another federal program extending financial aid to disabled individuals grappling with constrained income and resources, irrespective of their labor history.

Employer-Provided Group Disability Insurance: Abundantly proffered by employers as part of their comprehensive benefits suite, this coverage steps in with income replacement for staff members confronted with disability-induced work impediments.

Individual Disability Insurance: The realm of personalized protection. Acquired individually, these policies offer tailored income replacement provisions should disability strike, remaining steadfast even when professional landscapes change.

Short-Term Disability Insurance: The swift responder, catering to temporary disabilities, often lingering up to half a year, stemming from ailments or accidents.

Long-Term Disability Insurance: The stalwart guardian, ensuring income sustenance over an extended horizon, occasionally persisting until retirement, when grappling with enduring disabilities precluding substantial gainful activity.

Workers' Compensation: State-mandated insurance, offering succor to workers felled by work-linked injuries or ailments, embracing disability benefits as part of its comprehensive package.

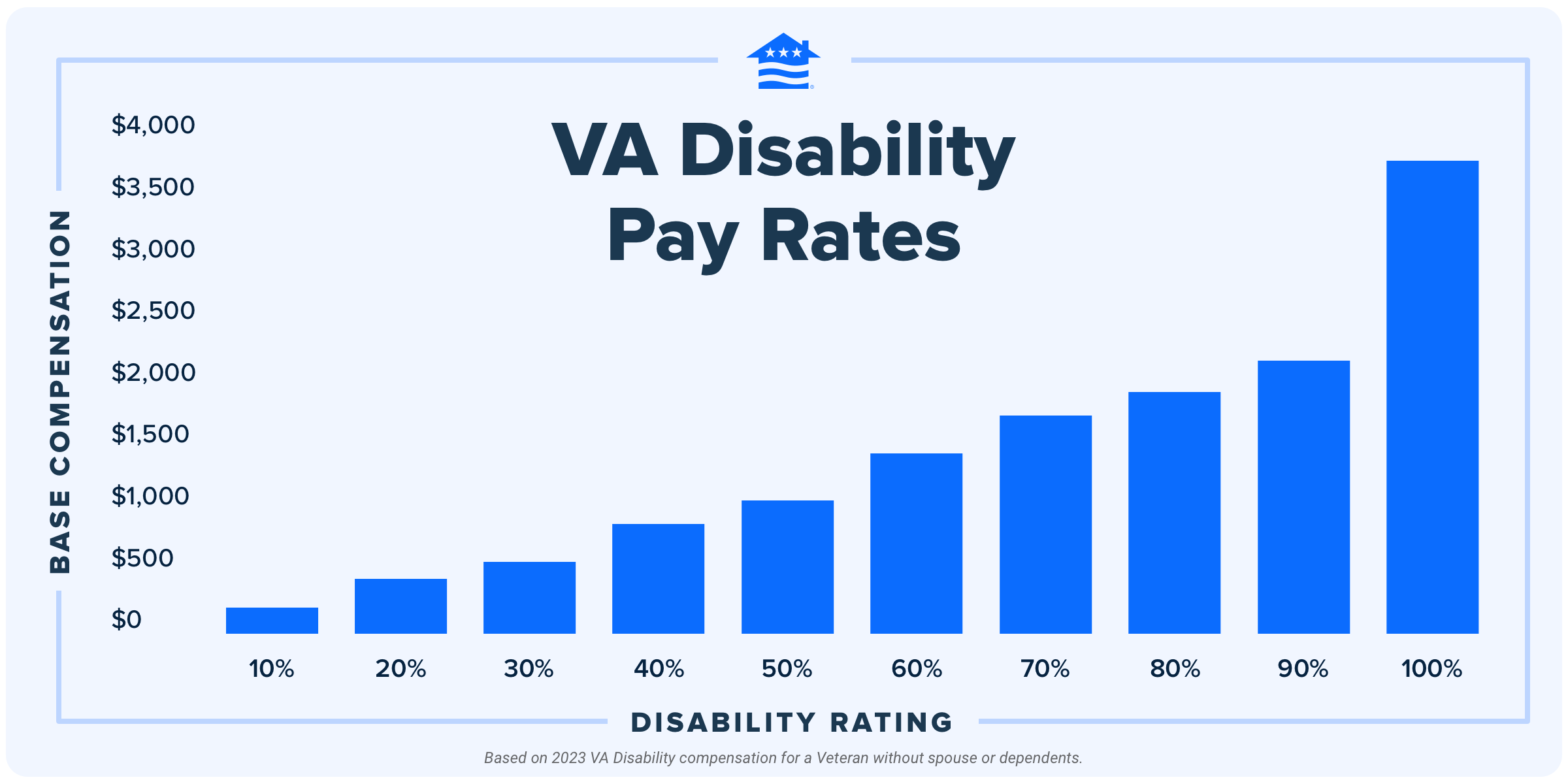

Veterans Affairs (VA) Disability Benefits: Veterans deserving of recognition, compensated for service-linked disabilities and injuries, their sacrifice honored through these provisions.

Railroad Retirement Disability Annuity: An enclave for disabled railroad laborers, carving out sustenance when the capacity to work succumbs to disability.

State Disability Insurance (SDI): State-based shields, catering to non-work-linked maladies or injuries, extending temporary disability benefits to those found eligible.

Accident Disability Insurance: Tailored for the unforeseen, this genre proffers sanctuary for disabilities birthed from accidents, encompassing medical expenses, rehabilitation costs, and income replacement during convalescence.

Critical Illness Insurance: A unique sentinel, though not disability insurance per se, critical illness insurance bestows a lump-sum endowment upon diagnosis of severe maladies, such as cancer, heart ailments, or strokes. These funds offer a cushion to tackle medical bills and diverse fiscal exigencies during the illness, endowing financial resilience.

Business Overhead Expense (BOE) Insurance: A bastion for entrepreneurs, this insurance safeguards against financial hemorrhage in the event the business proprietor grapples with disability. It pledges continuity, covering expenses like rent, utilities, and staff salaries.

High-Limit Disability Insurance: Tailored for high-earning individuals, this insurance amplifies the safety net, offering more substantial benefits than traditional policies to ensure continuity of lifestyle and financial commitments during disability.

Residual Disability Insurance: An advocate for those enduring partial disabilities impacting their work and income. It furnishes partial benefits, in line with the percentage of income lost due to the disability.

Key Person Disability Insurance:Business-centric, this policy shields against financial voids arising from the incapacitation of pivotal employees or executives. It sponsors hiring and training replacements and additional expenses during the key person's disability.

Unemployment Disability Insurance: A unique state-level offering, this coverage lends a hand to individuals grappling with disability while unemployed or in transition between jobs. It supplies temporary financial sustenance during the disability episode.

Own-Occupation Disability Insurance:This policy's contours are defined by the policyholder's existing occupation. If they can't perform their precise professional role due to disability, they qualify for benefits, even if they can switch to a different occupation.

Any-Occupation Disability Insurance: In contrast to the "own-occupation" variant, "any-occupation" policies only dispense benefits if the policyholder is incapacitated for any job they are reasonably qualified for, based on their education, training, and experience.

In the labyrinth of disability insurance options, the United States offers a myriad of choices, each catering to diverse circumstances and needs. Selecting the right one entails careful consideration and expert guidance, ensuring financial stability when confronted with the uncertainties of life.

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Diverse Aspects of Disability Insurance in the United Kingdom:

Coverage and Benefits: Disability insurance policies in the UK exhibit variability concerning coverage and benefits. Policyholders retain the prerogative to designate the income level they wish to shield, commonly up to a predetermined percentage of their earnings before succumbing to disability. The initiation of benefit disbursements follows a waiting period, a temporal span ranging from several weeks to several months, contingent on the nuances of the policy terms.

Own-Occupation vs. Any-Occupation Coverage: Analogous to the United States, disability insurance in the UK proffers two categorizations of coverage. "Own-occupation" coverage confers benefits should the policyholder find themselves incapacitated in their specific profession due to disability. Conversely, "any-occupation" coverage solely extends benefits if the policyholder cannot undertake any suitable occupation compatible with their competencies and qualifications.

Long-Term Coverage: Disability insurance in the UK primarily revolves around protracted protection, with benefits enduring until the policyholder's ability to resume work, attainment of retirement age, or culmination of the policy term, whichever materializes first. The tenure of coverage is selectable upon policy acquisition.

Pre-Existing Conditions: Analogous to any insurance paradigm, disability insurance in the UK may encompass caveats for pre-existing medical conditions. Precise disclosure of one's medical history during the application process emerges as paramount.

Group and Individual Policies: Disability insurance in the UK manifests itself in both individual and group dimensions. Group policies oftentimes offer more economical coverage but may entail a less malleable approach compared to their individual counterparts.

Taxation of Benefits: Disability insurance benefits within the UK typically navigate a tax-free realm. This implies that policyholders are spared the obligation of remitting income tax on the benefit disbursements they receive.

Additional Riders: The policyholder may have the prerogative to supplement their disability insurance policy with riders or supplementary features. These appendages may encompass inflation safeguarding, thereby ensuring that the benefit sum adjusts commensurately with inflation, or a rehabilitation support rider, facilitating return-to-work programs.

State Benefits: In the UK, those whose capacity for labor wanes due to disability may find solace in state benefits such as Employment and Support Allowance (ESA) or Personal Independence Payment (PIP). These benefits extend financial sustenance to those encumbered with limited work capability or daily living skills. Nonetheless, state benefits may not fully underwrite all living expenditures, underscoring the value of private disability insurance as a complementary layer.

Waiting Periods and Benefit Periods: Disability insurance policies in the UK traditionally entail waiting periods before the initiation of benefit payments. These hiatuses span from a few weeks to several months, during which policyholders must rely on alternative resources. Simultaneously, policies establish benefit periods, stipulating the maximum duration over which benefits will be disbursed. Conventional benefit periods span two years, five years, or endure until retirement age.

Occupation Categories: Disability insurance policies in the UK frequently stratify occupations into diverse risk categories. Occupations characterized as higher risk may be subject to higher premiums stemming from an augmented likelihood of disability claims. Policyholders are well-advised to meticulously scrutinize their occupation's categorization within the policy to guarantee adequate coverage.

Indexation: Certain disability insurance policies present indexation, an attribute that automatically elevates the benefit quantum over time to counterbalance the impact of inflation. This provision sustains the benefit's real value through the years, warranting that coverage mirrors the ever-ascending cost of living.

Medical Underwriting: In the process of applying for disability insurance, the insurance provider may solicit medical underwriting to assess the policyholder's health and pre-existing medical conditions. The insurer might then calibrate premiums or incorporate specific exclusions contingent on the policyholder's health status.

Renewability: Disability insurance policies in the UK may embrace divergent renewal options. "Non-cancellable" policies guarantee that the insurance company cannot revoke the coverage or amplify premiums unless the policyholder discontinues premium remittances. "Guaranteed renewable" policies ensure that the policy can be extended, albeit with the caveat that premiums may be subject to alterations contingent on broader claims experiences.

Free Look Period: Similar to other insurance genres, disability insurance policies in the UK habitually encompass a "free look" span. During this interval, typically extending from 14 to 30 days post-policy issuance, policyholders possess the privilege to scrutinize the terms and conditions. Subsequently, they can opt to persist with the coverage or rescind the policy, receiving full reimbursement of any disbursed premiums.

Independent Financial Advice: Given the intricacies inherent in selecting the most judicious disability insurance policy, it is sagacious for individuals to solicit independent financial counsel. Such consultation facilitates a comprehensive grasp of options, an appraisal of needs, and the election of the most pertinent coverage consonant with specific circumstances and fiscal objectives.

Exploring the Vast Landscape of Disability Insurance in the United Kingdom:

Best Disability Insurance Plans: Individuals in quest of the foremost disability insurance policies endowed with top-notch ratings and comprehensive features.

Affordable Disability Insurance Coverage: Prospective policyholders seeking disability insurance schemes furnishing substantial coverage at rates aligning with budgetary considerations.

Top Disability Insurance Companies: Endeavors to procure insights into the most prominent insurance entities offering distinguished disability insurance products.

Compare Disability Insurance Quotes: Initiatives aimed at comparing quotations from a multitude of insurance providers to pinpoint the optimal disability insurance policy for individual requisites.

Disability Insurance for Self-Employed: Self-employed professionals on a quest for disability insurance to safeguard their income in scenarios of incapacitation curbing work endeavors.

Long-Term Disability Insurance Benefits: Exploration into the advantages proffered by long-term disability insurance policies, which extend coverage across extended durations.

Short-Term Disability Insurance Explained: A quest for enlightenment concerning short-term disability insurance, a class of coverage typically spanning up to six months, dedicated to addressing transitory disabilities emanating from ailments or accidents.

Disability Insurance vs. Workers' Compensation: Inquisitive minds endeavoring to draw distinctions between disability insurance and workers' compensation, aiming to comprehend the variance in coverage and eligibility requisites.

Disability Insurance Eligibility Criteria: A focus on the prerequisites applicants must satisfy to qualify for disability insurance coverage.

Understanding Disability Insurance Policies: An indication that users aspire to grasp the comprehensive panorama of disability insurance policies, encompassing their attributes and stipulations.

Disability Insurance Benefits Explained: The quest to unearth insights into the multifaceted benefits proffered by disability insurance, including income replacement and other covered expenses.

How Does Disability Insurance Work?: Inquiries directed toward understanding the modus operandi of disability insurance, including the procedure for asserting claims and acquiring benefits.

Best Disability Insurance Policies for Families: Individuals seeking disability insurance plans custom-tailored to cater to the distinctive financial needs of families.

Disability Insurance Coverage for Pre-Existing Conditions: Inquiry pertinent to individuals possessing pre-existing medical conditions, endeavoring to unearth information about disability insurance coverage options.

No Medical Exam Disability Insurance: The exploration of disability insurance policies eschewing medical examinations

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

Q1. What is disability insurance?

Answer: Disability insurance, also known as income protection insurance, is a type of insurance that provides financial support to individuals who are unable to work due to a disability or illness. It offers a replacement income, helping policyholders cover essential living expenses during their period of incapacity.

Q2. How does disability insurance work?

Answer: When a policyholder becomes disabled and is unable to work, they can file a disability insurance claim. The insurance provider may require medical documentation and evidence of the disability to assess the claim. Once approved, the policyholder receives regular benefit payments, usually a percentage of their pre-disability earnings, to replace lost income during the disability period.

Q3. What types of disability insurance are available?

Answer: There are two primary types of disability insurance: short-term disability insurance and long-term disability insurance. Short-term disability insurance provides coverage for a limited duration, usually up to six months, while long-term disability insurance offers benefits for an extended period, often until retirement age.

Q4. How much disability insurance coverage do I need?

Answer: The appropriate coverage amount depends on various factors, such as your current income, living expenses, and financial commitments. Ideally, disability insurance should aim to replace a significant portion of your pre-disability income to ensure financial stability during incapacity.

Q5. Is disability insurance tax-free?

Answer: In most cases, disability insurance benefits are tax-free. The benefit payments are not subject to income tax, providing a valuable and reliable source of financial support during times of disability.

Q6. What is the waiting period for disability insurance?

Answer: The waiting period, also known as the elimination period, is the initial period after the disability occurs during which the policyholder is not eligible for benefits. Waiting periods typically range from a few weeks to several months, and the policyholder can choose the waiting period at the time of policy purchase.

Q7. Can I get disability insurance through my employer?

Answer: Many employers offer group disability insurance as part of their benefits package. Group disability insurance can provide coverage at a lower cost, but the benefits and coverage terms may be less customizable compared to individual disability insurance policies.

Q8. Is disability insurance worth it if I have savings?

Answer: While having savings is essential, disability insurance provides an extra layer of financial protection. It ensures that you have a consistent income stream during disability, preventing you from depleting your savings entirely and maintaining your financial stability.

Q9. Does disability insurance cover pre-existing conditions?

Answer: Disability insurance policies may have exclusions for pre-existing medical conditions. It's crucial to review the policy terms and disclose any pre-existing conditions accurately during the application process.

Q10. Can I get disability insurance if I work part-time or have a high-risk occupation?

Answer: Disability insurance is available for both part-time and full-time workers. However, individuals with high-risk occupations may have higher premiums due to the increased likelihood of disability claims related to their occupation.

Q11. Can I cancel my disability insurance policy if I change my mind?

Answer: Most disability insurance policies come with a "free look" period, during which the policyholder can review the terms and conditions. If unsatisfied, they can cancel the policy and receive a full refund of any premiums paid within the specified period.

Q12. Is disability insurance available for self-employed individuals?

Answer: Yes, self-employed individuals can purchase individual disability insurance policies to protect their income in case of disability. It's essential to explore the available options and tailor the coverage to their specific needs.

Q13. Can I receive disability insurance benefits while on unemployment?

Answer: Disability insurance benefits are separate from unemployment benefits. If a policyholder becomes disabled while unemployed, they can still receive disability insurance benefits if they meet the policy's criteria for disability.

Q14. Will disability insurance cover mental health conditions?

Answer: Disability insurance can cover mental health conditions if they meet the policy's definition of disability. However, coverage for mental health conditions may vary depending on the policy's terms and exclusions.

Q15. How much does disability insurance cost?

Answer: The cost of disability insurance varies based on factors such as the coverage amount, waiting period, benefit period, age, health, and occupation. It's best to obtain quotes from different insurance providers to compare costs and coverage options

| Car Insurance |

| Homeowners Insurance |

| Life Insurance Plan |

| Commercial Insurance Brokers |

| Pet Insurance Plan |

| Renters Insurance Plan |

| Best Credit Cards |

| AAA Trip Interruption |

© Insurance Life Plan. All Rights Reserved. POWERD BY ![]()